In an effort to streamline the process of locating unclaimed deposits, the Reserve Bank of India (RBI) has introduced the RBI Udgam Portal, an abbreviation for Unclaimed Deposits – Gateway to Access Information. This consolidated web platform aims to simplify the search for unclaimed deposits across multiple banks, providing a convenient solution for consumers. Here’s everything you need to know about the RBI Udgam Portal, including its highlights, objectives, features, benefits, participating banks, registration steps, login process, and contact details.

Overview of the RBI Udgam Portal

As announced in the statement on developmental and regulatory policies dated April 6, 2023, the RBI has introduced a centralized web facility for searching unclaimed deposits. With the rising trend in unclaimed deposits, the RBI has initiated public awareness programs to inform citizens about this issue and encourage them to reclaim their funds from banks.

Highlights of the RBI Udgam Portal

- Name: RBI Udgam Portal

- Full Form: Unclaimed Deposits – Gateway to Access Information

- Introduced by: Reserve Bank of India (RBI)

- Beneficiaries: Citizens of India

- Official Website: RBI Udgam Portal

Objective

The primary objective of the RBI Udgam Portal is to facilitate the identification of unclaimed deposits for consumers. By providing access to information about their dormant accounts, individuals can choose to reactivate their accounts or claim the deposited amount.

Features & Benefits

- The Udgam Portal was launched by the RBI in collaboration with participating banks, Indian Financial Technology & Allied Services (IFTAS), and Reserve Bank Information Technology Pvt Ltd (ReBIT).

- Users can access information about their unclaimed deposits across seven banks already integrated into the portal.

- The search function for additional banks will gradually become available by October 15.

- Unclaimed deposits include balances in savings/current accounts inactive for 10 years or term deposits unclaimed within the same period.

- Bank depositors retain the right to reclaim unclaimed funds, including accrued interest, from their respective banks.

- Despite awareness initiatives, the number of unclaimed deposits continues to rise due to various reasons outlined by the RBI.

Participating Banks

The RBI Udgam Portal currently includes information about unclaimed deposits from the following banks:

- State Bank of India

- Punjab National Bank

- Central Bank of India

- Dhanlaxmi Bank Ltd.

- South Indian Bank Ltd.

- DBS Bank India Ltd.

- Citibank N.A.

(Note: Additional banks will be gradually added to the portal.)

Steps to Register on the RBI Udgam Portal

To register on the Udgam Portal, follow these steps:

- Visit the official website of RBI Udgam Portal: RBI Udgam Portal

- Click on the “Register” option under the login window.

- Fill in the registration form with required details such as mobile number, name, password, and captcha code.

- Accept the declarations and proceed to fill in additional details.

- Click on the “Register” button to complete the registration process.

- Steps to Login

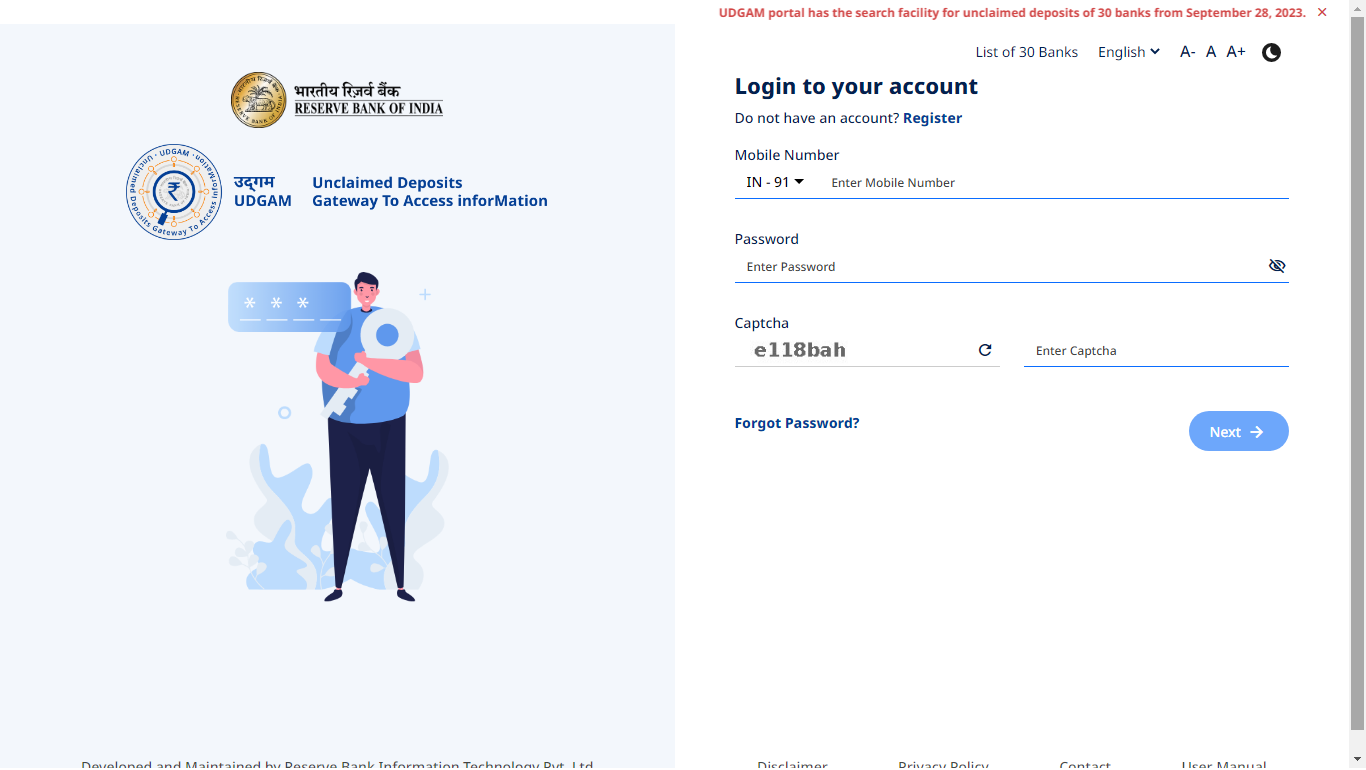

To login to the portal, follow these steps:

- Visit the official website of RBI Udgam Portal: RBI Udgam Portal

- Enter your registered mobile number and password.

- Input the captcha code.

- Click on the “Next” button to log in to your account.

For further assistance or queries related to the Udgam Portal, you can reach out to the UDGAM Support Team via email at udat@rbi.org.in .

Unlock the potential of your dormant deposits with the Udgam Portal. Explore, reclaim, and secure your financial assets effortlessly. Join the initiative today and take control of your unclaimed deposits!

Read more:

Borrowers, Take Note: RBI Announces New Measures for Transparent Loan Costs with Key Fact Statements

Learn About the Latest RBI Guidelines for Directly Crediting Your Bank Account with Rs 2,000 Notes

Significant Development in the PM Vishwakarma Scheme: RBI Joins Government in Supporting Artisans

Report: RBI to Unveil Central Bank Digital Currency in Call Money Market

RBI Udgam Portal FAQs

What is the RBI Udgam Portal?

The RBI Udgam Portal, short for Unclaimed Deposits – Gateway to Access Information, is a centralized web platform introduced by the Reserve Bank of India (RBI) to facilitate the search for unclaimed deposits across multiple banks.

What is the objective of the RBI Udgam Portal?

The primary objective of the RBI Udgam Portal is to assist consumers in identifying their unclaimed deposits, enabling them to reactivate dormant accounts or claim the deposited amount.

Who can benefit from the RBI Udgam Portal?

The RBI Udgam Portal is designed to benefit citizens of India who may have unclaimed deposits in various banks.

What are the key features and benefits of the RBI Udgam Portal?

The portal was launched in collaboration with participating banks, IFTAS, and ReBIT. Users can access information about their unclaimed deposits across seven integrated banks. The search function for additional banks will be gradually available. Unclaimed deposits include balances in inactive savings/current accounts or unclaimed term deposits. Depositors retain the right to reclaim funds from their respective banks. Despite awareness initiatives, the number of unclaimed deposits continues to rise.

Which banks are currently part of the RBI Udgam Portal?

Currently, the portal includes information about unclaimed deposits from State Bank of India, Punjab National Bank, Central Bank of India, Dhanlaxmi Bank Ltd., South Indian Bank Ltd., DBS Bank India Ltd., and Citibank N.A.

How can I register on the RBI Udgam Portal?

What are the steps to log in to the RBI Udgam Portal?

How can I contact the support team for assistance with the RBI Udgam Portal?

For further assistance or queries, you can reach out to the UDGAM Support Team via email at udat@rbi.org.in.

What are the reasons behind the rising trend in unclaimed deposits?

Unclaimed deposits primarily occur due to depositors failing to close outgoing accounts or notify banks of redemption requests for fixed deposit maturities. In some cases, nominees or legal heirs fail to claim deposits of deceased depositors.

How can reclaiming unclaimed deposits benefit individuals?

Reclaiming unclaimed deposits ensures individuals regain control over their financial assets, including any accrued interest, providing financial security and peace of mind.