The Indian Post Office offers numerous investment schemes, delivering good returns to investors. One such beneficial scheme is the Post Office MSSC Scheme (Mahila Samman Savings Certificate). This initiative is tailored specifically for women, providing a secure investment opportunity with attractive returns.

Overview of the Post Office MSSC Scheme

Name of the Scheme: Post Office Mahila Samman Savings Certificate Scheme (MSSC)

Year of Commencement: 2023

Operation: Managed by the Post Office

Beneficiary: Women and parents of minor girls

Interest Rate: 7.5% per annum

Deposit Limit: Minimum ₹1,000, Maximum ₹2,00,000

Maturity Period: 2 years

Application Process: Offline

Required Documents: Aadhaar Card, PAN Card, Passport Size Photo, Mobile Number

Last Date for Account Opening: 31 March 2025

Interest Payment: Quarterly basis

Payment on Maturity: Upon submission of Form-2 to the Accounts Office

Post Office Charges: Receipt in physical mode: ₹40, Electronic mode: ₹9, Per ₹100 turnover: ₹6.5

Benefits of the Post Office MSSC Scheme

- Exclusive for Women: This scheme is designed to empower women, offering a reliable savings option.

- High Interest Rate: Investors enjoy a substantial interest rate of 7.5% per annum, paid quarterly.

- Flexible Investment: Women can invest between ₹1,000 and ₹2,00,000 annually.

- Tax Benefits: The interest earned up to ₹40,000 is exempt from tax, providing additional financial relief.

- Financial Independence: This scheme helps women achieve economic development and self-reliance.

- Guaranteed Returns: The investment matures in two years, ensuring a secure return on investment.

Eligibility Criteria for the Post Office MSSC Scheme

- Residency: The applicant must be a permanent resident of India.

- Age: Women and girls below 18 years can apply. For minors, the account can be opened by a guardian.

- Documentation: Necessary documents include Aadhaar card, PAN card, passport size photo, and a mobile number.

How to Open an MSSC Account

- Visit the Post Office: Go to your nearest post office to start the process.

- Obtain the Application Form: Request the Mahila Samman Bachat Patra Yojana application form.

- Fill Out the Form: Carefully fill out the form with the required information.

- Submit Required Documents: Attach photocopies of the necessary documents (Aadhaar, PAN, etc.).

- Deposit the Initial Amount: Deposit the minimum amount or provide a check to open the account.

- Account Activation: Upon verification, your account will be activated.

Detailed Application Process

To avail the benefits of the Post Office MSSC Scheme, follow these steps:

- Get Information: Visit the post office and inquire about the Mahila Samman Bachat Patra Yojana.

- Application Form: Collect the application form and read the instructions thoroughly.

- Complete the Form: Fill in all the required details accurately.

- Attach Documents: Attach the necessary documents including Aadhaar card, PAN card, and passport size photos.

- Submit the Form: Submit the completed form and documents at the post office.

- Deposit Funds: Deposit the required amount to open your MSSC account.

Fees Associated with the Post Office MSSC Scheme

- Physical Receipt: ₹40

- Electronic Receipt: ₹9

- Per ₹100 Turnover: ₹6.5

The Post Office Mahila Samman Savings Certificate Scheme (MSSC) is an excellent financial tool for women aiming to secure their future with a safe and high-return investment. By offering a significant interest rate, tax benefits, and a straightforward application process, the MSSC Scheme ensures that women can achieve financial independence and stability.

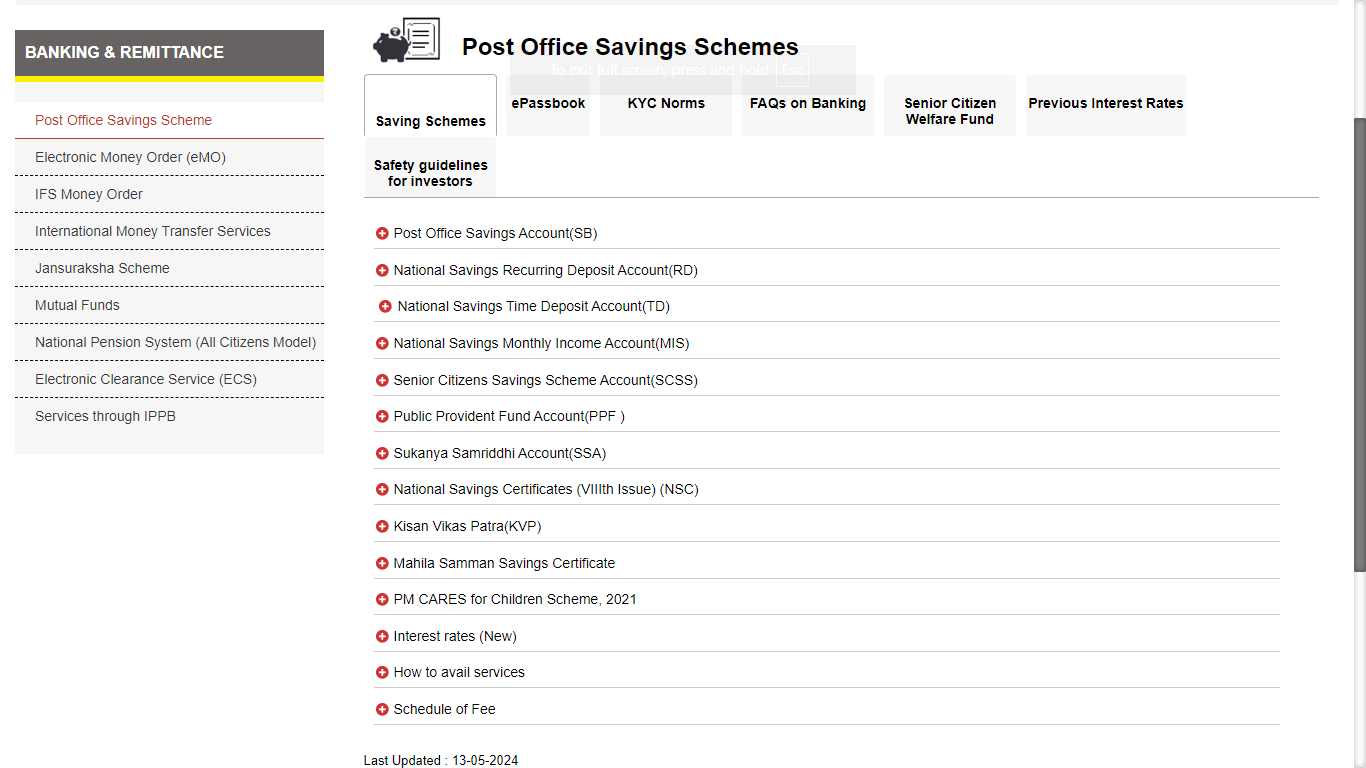

To stay updated on the most beneficial post office savings schemes, please visit India Post.

Post Office MSSC Scheme FAQs:

What is the Post Office MSSC Scheme (Mahila Samman Savings Certificate Scheme)?

The MSSC is an investment scheme offered by the Indian Post Office, specifically designed for women, including parents of minor girls, providing a secure investment option with attractive returns.

When was the Post Office MSSC Scheme (Mahila Samman Savings Certificate Scheme) introduced?

The MSSC Scheme commenced in the year 2023.

Who can benefit from the Post Office MSSC Scheme?

The scheme is tailored for women and parents of minor girls, aiming to empower women with financial security and independence.

What is the interest rate offered under the MSSC Scheme?

The MSSC Scheme offers an interest rate of 7.5% per annum, which is paid quarterly.

What is the deposit limit for the MSSC Scheme?

The minimum deposit limit is ₹1,000 and the maximum deposit limit is ₹2,00,000.

What is the maturity period for investments in the MSSC Scheme?

Investments in the MSSC Scheme mature in 2 years.

What are the necessary documents required to open an MSSC account?

The required documents are Aadhaar Card, PAN Card, Passport Size Photo, and a Mobile Number.

What are the post office charges associated with the MSSC Scheme?

The charges are ₹40 for physical receipts, ₹9 for electronic receipts, and ₹6.5 per ₹100 turnover.

Are there any tax benefits associated with the MSSC Scheme?

Yes, the interest earned up to ₹40,000 is exempt from tax, providing additional financial relief to the investors.

How can one open an MSSC account?

To open an MSSC account, visit the nearest post office, obtain and fill out the application form, attach the necessary documents, and deposit the initial amount. The account will be activated upon verification.

Comprehensive Guide to the Post Office Monthly Income Scheme (MIS)