In today’s dynamic world, prioritizing savings has become more crucial than ever. Acknowledging this necessity, the Indian government, through India Post, presents a diverse array of saving schemes under the Post Office Saving Scheme umbrella. These schemes not only offer appealing interest rates but also come with tax benefits, rendering them a preferred choice for investors aiming to fortify their financial prospects. Let’s delve into the nuances of the Post Office Saving Scheme 2024 and uncover its potential benefits.

Understanding Post Office Saving Scheme

The Post Office Saving Scheme comprises a spectrum of financial instruments meticulously crafted to instill the habit of saving among Indian citizens. Whether you’re a salaried professional, a senior citizen, or a parent envisioning a secure future for your child, there exists a scheme tailored to cater to your specific requirements. Ranging from the Public Provident Fund to the Senior Citizen Saving Scheme, each scheme boasts distinctive features and advantages for investors.

Types of Post Office Saving Scheme

- Post Office Savings Account: Resembling a traditional bank account, this scheme offers a convenient avenue for accumulating savings with an enticing interest rate of 4%.

- Post Office Time Deposit Scheme: Featuring flexible tenure options spanning from 1 to 5 years, this scheme proffers competitive interest rates of up to 6.7%.

- Sukanya Samriddhi Scheme: Geared towards empowering girls, this scheme boasts an impressive interest rate of 7.6% and promotes long-term savings with a minimum investment of ₹1000 annually.

- National Savings Certificate: Sporting a fixed maturity period of 5 years and an appealing interest rate of 6.8%, this scheme remains a sought-after choice among investors seeking stable returns.

- Public Provident Fund: With a tenure extending to 15 years and an attractive interest rate of 7.1%, this scheme extends tax benefits under Section 80C of the Income Tax Act.

- Senior Citizen Saving Scheme: Tailored for individuals aged 60 and above, this scheme offers an elevated interest rate of 7.4% and assures financial security during retirement.

- Kisan Vikas Patra: Tailored for the agricultural community, this scheme offers a compelling interest rate of 6.9% and encompasses a tenure of 9 years and 4 months.

- Post Office Recurring Deposit: Ideal for investors seeking monthly returns, this scheme offers an interest rate of 5.8% and necessitates a minimum investment of ₹10 per month.

- Post Office Monthly Income Scheme: Guaranteeing a fixed monthly income, this scheme provides an interest rate of 6.6% and ensures financial stability for investors.

Benefits of Post Office Saving Scheme

- Encourages individuals to cultivate a habit of saving and enhance their financial well-being.

- Streamlined application process with minimal documentation requirements.

- Government-backed schemes offer assurance and security for investments.

- Tax benefits under Section 80C of the Income Tax Act incentivize long-term savings.

- Diverse range of schemes cater to varied financial needs and aspirations.

How to Apply for Post Office Saving Scheme 2024

- Visit your nearest post office.

- Obtain the application form for your desired scheme.

- Accurately fill in the required details.

- Attach essential documents such as Aadhar card, PAN card, and proof of residence.

- Submit the completed form along with the documents to the post office.

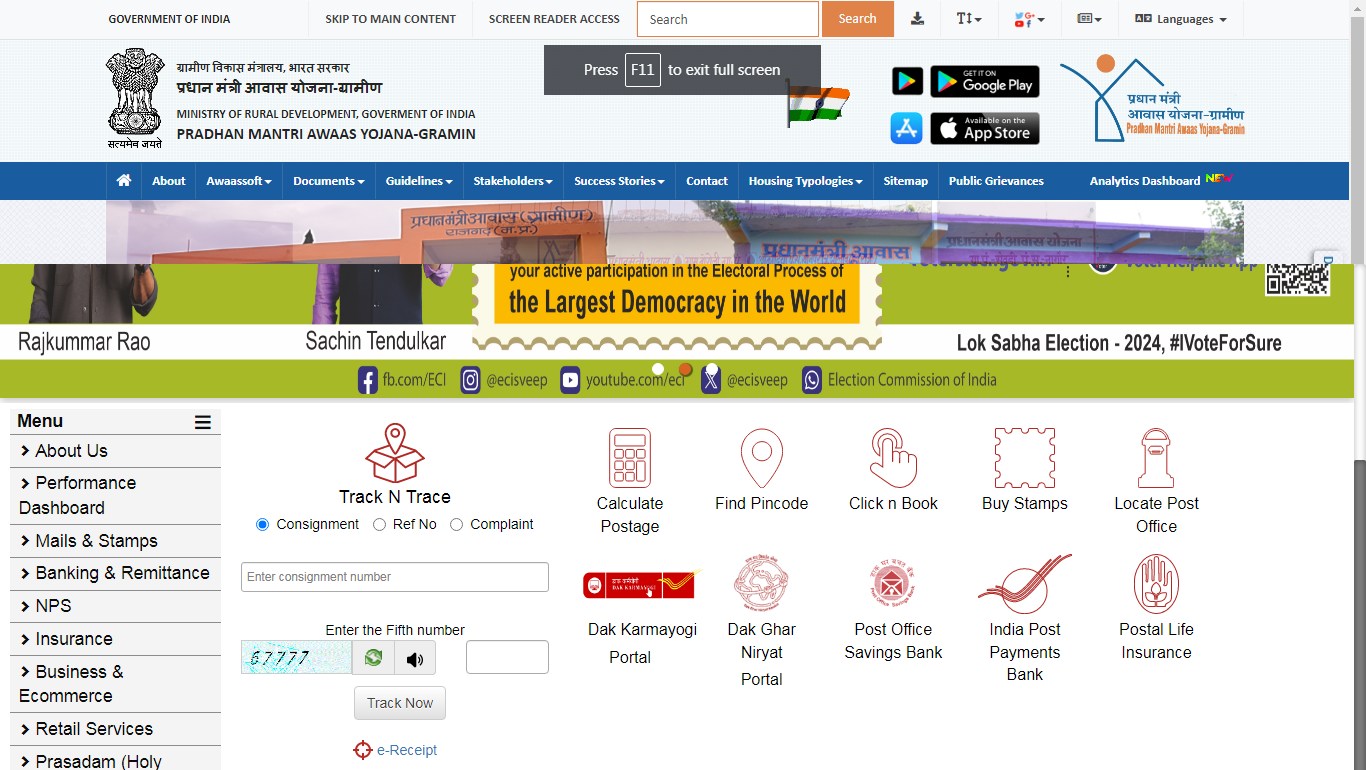

- To get more information about Post Office Savings Schemes visit the official website https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx

The Post Office Saving Scheme 2024 presents a plethora of opportunities for individuals to safeguard their financial future. Whether you aspire to save for retirement, your child’s education, or build an emergency fund, there exists a scheme tailored to your needs. With enticing interest rates, tax benefits, and a hassle-free application process, investing in these schemes emerges as a prudent choice for anyone seeking financial security.

For further information and assistance, visit the official website of India Post or reach out to the toll-free helpline at 18002666868. Embark on your journey towards financial stability today with the Post Office Saving Scheme 2024.

Read more:

Understanding ELSS Mutual Funds: Comparing Tax Saving Benefits and Returns with PPF and FD

Post Office Saving Scheme FAQs:

What is the Post Office Saving Scheme?

The Post Office Saving Scheme encompasses various financial instruments aimed at promoting the habit of saving among Indian citizens, offering attractive interest rates and tax benefits.

Who can benefit from the Post Office Saving Scheme?

Individuals from diverse backgrounds, including salaried professionals, senior citizens, and parents planning for their child's future, can benefit from the scheme tailored to meet their specific requirements.

What are the different types of schemes under the Post Office Saving Scheme umbrella?

The schemes include the Post Office Savings Account, Post Office Time Deposit Scheme, Sukanya Samriddhi Scheme, National Savings Certificate, Public Provident Fund, Senior Citizen Saving Scheme, Kisan Vikas Patra, Post Office Recurring Deposit, and Post Office Monthly Income Scheme.

How does the Post Office Savings Account work?

Similar to a traditional bank account, the Post Office Savings Account offers a convenient way to accumulate savings with an attractive interest rate of 4%.

What are the benefits of the Public Provident Fund?

The Public Provident Fund offers a tenure of 15 years with an attractive interest rate of 7.1% and extends tax benefits under Section 80C of the Income Tax Act.

How can one apply for the Post Office Saving Scheme?

Interested individuals can visit their nearest post office, obtain the application form for the desired scheme, fill in the required details accurately, attach essential documents such as Aadhar card and PAN card, and submit the completed form along with the documents to the post office.

What documents are required to apply for the Post Office Saving Scheme?

Essential documents include Aadhar card, PAN card, and proof of residence.

What are the benefits of investing in the Post Office Saving Scheme?

The scheme encourages the habit of saving, offers a streamlined application process, provides assurance and security for investments backed by the government, and extends tax benefits under Section 80C of the Income Tax Act.

Where can one find more information about Post Office Savings Schemes?

Individuals can visit the official website of India Post at https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx for detailed information about Post Office Savings Schemes.

How can individuals seek further assistance regarding the Post Office Saving Scheme?

For further information and assistance, individuals can visit the official website of India Post or reach out to the toll-free helpline at 18002666868.

2 thoughts on “Secure Your Future: Post Office Saving Schemes 2024 (High Interest, Tax Benefits) | डाकघर बचत योजनाएँ 2024 की व्याख्या (उच्च दरें, कर लाभ)”