Are you searching for a dependable investment avenue that offers impressive returns along with security? Look no further than the Post Office RD Scheme (Recurring Deposit). Recognized for its stability and promising returns, the Post Office RD Scheme has become the preferred choice for many investors. With the recent increase in interest rates by the government, now is the ideal time to explore this investment opportunity.

Why Opt for Post Office RD Scheme?

The Post Office RD Scheme emerges as a lucrative option for those aiming to invest their hard-earned money wisely. With the potential to accumulate funds exceeding Rs 8 lakh in just 10 months, this scheme offers hassle-free investment with assured returns. Whether you’re a salaried individual or a professional seeking to maximise returns on your savings, the Post Office RD Scheme provides an enticing avenue for wealth accumulation.

Secure Your Future with Post Office RD Scheme 2024

The Post Office Recurring Deposit (RD) Scheme for 2024 presents an excellent opportunity to generate substantial returns by investing nominal amounts regularly. By committing to deposit a fixed sum each month, investors can enjoy attractive returns over a predetermined period. This scheme empowers individuals to safeguard their financial future while enjoying the peace of mind that comes with a government-backed initiative.

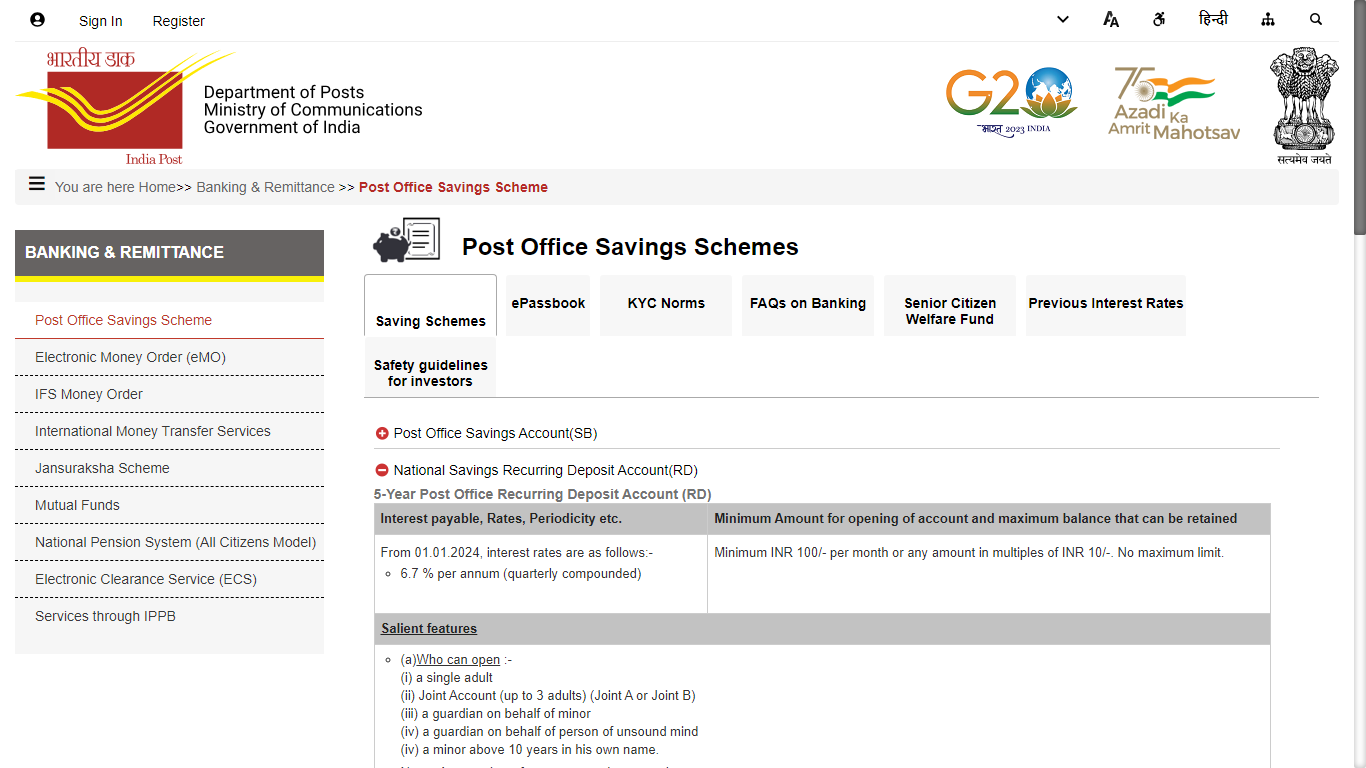

Recent Updates and Interest Rates

The government’s decision to increase the interest rate on the Post Office RD Scheme underscores its commitment to fostering a conducive investment environment. With the interest rate for the 5-year RD scheme set at 6.7 percent between October and December 2023, investors stand to benefit from higher returns on their investments. These revised rates, effective from October 1 to December 31, 2023, enhance the appeal of the scheme, making it more rewarding for investors.

Building Wealth, One Step at a Time

Investing in the Post Office RD Scheme allows individuals to build a substantial corpus by contributing modest amounts regularly. For instance, investing Rs 5,000 per month for 5 years can yield a maturity amount of Rs 3 lakh, along with an interest of Rs 56,830 at the rate of 6.7 percent. By extending the RD account for 10 years, investors can accumulate a significant sum of Rs 8 lakh 54,272, showcasing the potential for wealth creation through disciplined saving.

Loan Facility and Premature Closure

Apart from offering attractive returns, the Post Office RD Scheme provides the flexibility of availing loans against the deposited amount. Investors can obtain a loan of up to 50 percent of the total deposit amount, with the option of premature closure available after 3 years of investment. Additionally, the scheme allows for partial withdrawal of funds in case of financial emergencies, further enhancing its appeal among investors.

How to Get Started

Opening an account under the Post Office RD Scheme is a straightforward process. Simply visit your nearest post office and inquire about the RD Scheme. Complete the application form, providing the necessary documents such as Aadhar card, identity proof, address proof, mobile number, passport size photo, and email ID. Once the application is submitted along with the investment amount, your account will be activated, setting you on the path to financial prosperity.

Stay Informed

While there’s no specific official website dedicated to the Post Office RD Scheme, you can stay updated on any new developments by visiting the official website of the Indian Postal Department at https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx.

In conclusion, the Post Office RD Scheme stands as a reliable and rewarding investment option for individuals looking to secure their financial future. With its attractive returns, flexibility, and government backing, this scheme offers a compelling avenue for wealth creation. By investing wisely and staying informed, you can embark on a journey towards financial stability and prosperity with the Post Office RD Scheme.

Read more:

Comprehensive Guide to the Post Office Monthly Income Scheme (MIS)

How to Reactivate Your Dormant Post Office Savings Account

What is the Tax Deduction Limit for Section 80C in FY 2024-25 Post Interim Budget 2024?

Secure Your Future: Exploring the Hidden Gems of the Post Office Senior Citizen Saving Scheme

Post Office RD Scheme FAQs

What is the Post Office RD Scheme?

The Post Office RD Scheme is a safe and secure investment option offered by the Indian government. It allows you to invest a fixed amount each month over a chosen tenure to earn interest and accumulate a corpus.

Why choose the Post Office RD Scheme?

This scheme offers guaranteed returns, government backing, and the flexibility to invest small amounts regularly. It's suitable for salaried individuals, professionals, or anyone seeking to build wealth gradually.

What are the current interest rates for the RD Scheme?

As of October-December 2023, the interest rate for the 5-year RD scheme is 6.7%.

How much can I earn with the RD Scheme?

With regular deposits and interest compounding, you can accumulate a significant sum. For example, investing Rs 5,000 monthly for 5 years can yield Rs 3 lakh.

Can I extend the RD scheme beyond 5 years?

Yes, the RD scheme allows for a tenure of up to 10 years. This can help you accumulate an even larger corpus.

Can I withdraw money before the maturity period?

Premature closure is allowed after 3 years, but with a penalty. The scheme also offers partial withdrawals for emergencies.

Can I avail a loan against my RD investment?

Yes, you can get a loan of up to 50% of the deposit amount after a certain period.

How do I open an RD account?

Visit your nearest post office and inquire about the scheme. Fill out the application form and submit it with your KYC documents and the initial investment amount.

Is there an online portal for the RD Scheme?

While there's no dedicated website, you can visit the India Post website (https://www.indiapost.gov.in/vas/Pages/IndiaPostHome.aspx) for updates.

Is the RD scheme a good investment option?

The RD scheme is ideal for risk-averse investors seeking guaranteed returns and a safe way to build wealth through regular saving.

One thought on “Invest Wisely with Post Office RD Scheme: A Secure Path to Financial Growth | आज ही बचत शुरू करें: डाकघर आरडी योजना का अन्वेषण करें”