The Indian government has been proactive in facilitating the establishment of new enterprises through various initiatives, one of which is the Stand Up India Loan Scheme. This program, initiated to empower marginalized groups including women, scheduled castes, and scheduled tribes, has made significant strides in the last seven years, disbursing over Rs. 40,700 crore to more than 1,80,630 accounts. Let’s delve into the comprehensive details of the Stand Up India Loan Scheme.

Stand Up India Loan Scheme

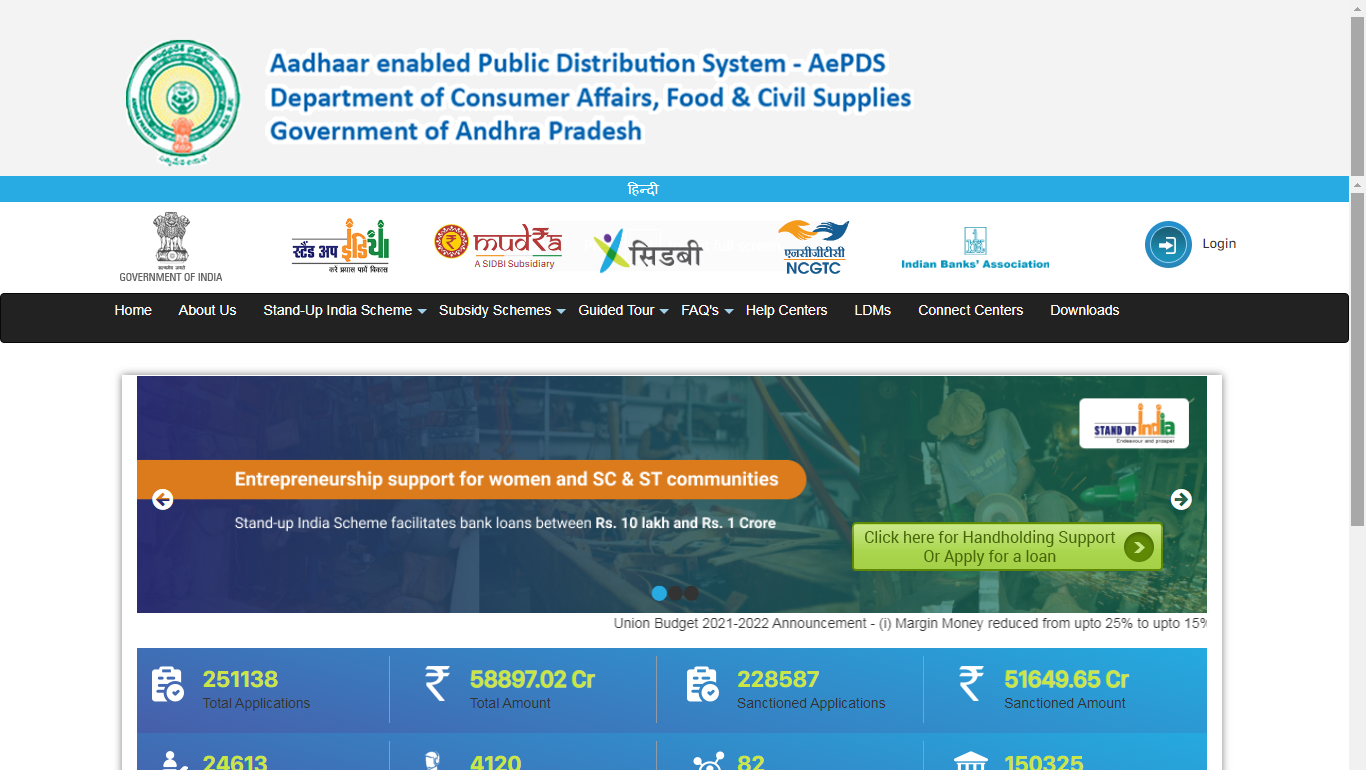

Administered by the Department of Financial Services (DFS), Ministry of Finance, Government of India, the Stand-Up India Loan Scheme is facilitated by the Small Industries Development Bank of India (SIDBI). This program encompasses trading, industrial, service industry activities, and even farming-related endeavors. It encourages the establishment of businesses in various forms such as cooperatives, partnerships, firms, sole proprietorships, and more.

Stand Up India Loan Scheme Details in Highlights

- Name: Stand Up India Loan Scheme

- Interest Rate: Bank’s MCLR + 3% + Tenor Premium

- Loan Amount: Rs. 10 lakh to Rs. 1 crore

- Loans Offered For: Only Green Field Projects

- Working Capital Limit: Up to Rs. 10 lakh in the form of Cash Credit limit

- Minimum Age: 18 years for ST/SC and Women Entrepreneurs

- Repayment Tenure: Maximum 7 years with a Moratorium Period of up to 18 months

- Margin: Maximum 15%

- Shareholding or Controlling Stake: 51% for Non-Individual Enterprises

- Borrower’s Financial Repayment Status: Must not have defaulted to any bank or NBFC

Stand Up India Loan Scheme Objectives

The Stand-Up India Scheme aims to encourage women, scheduled caste (SC), and scheduled tribe (ST) members to initiate their businesses. Launched by Prime Minister Narendra Modi on April 5, 2016, it seeks to facilitate bank loans ranging from Rs. 10 lakh to Rs. 1 crore for the establishment of greenfield enterprises. Additionally, it provides aspiring entrepreneurs with hand-holding support, training, coaching, and guidance through the Stand-Up India Portal.

Features & Benefits of Stand Up India Loan Scheme

- Coverage of up to 75% of the project cost under the scheme.

- Inclusion of term and working capital loans in the composite loan.

- Guaranteed lowest interest rate offered by the bank.

- Repayment tenure of seven years with an 18-month moratorium period.

- Option to use collateral or Credit Guarantee Fund Scheme for Stand-Up India Loans guarantee.

- Provision of overdraft for loans up to Rs. 10 lakh along with a RuPay debit card.

- Inclusion of various banks under the scheme.

Interest Rates for Stand-Up India Loan

The interest rates for loans under the Stand-Up India program are determined by participating banks based on their internal policies. However, the interest rate cannot exceed the bank’s lowest applicable rate for that category (MCLR + 3% + tenure premium).

List of Banks under Stand Up India Loan Scheme

Several banks participate in the Stand Up India Loan Scheme, including Axis Bank, Bank of India, Bank of Baroda, ICICI Bank, State Bank of India, and more.

Eligibility Criteria for Stand Up India Loan Scheme

To avail the benefits of the Stand Up India Loan Scheme, applicants must meet the following criteria:

- Exclusive availability for women entrepreneurs and SC/ST individuals.

- Minimum age requirement of eighteen years.

- Open to greenfield projects only.

- Ownership of at least 51% of the company’s shares and controlling holdings by women entrepreneurs or SC/ST members.

- Non-default status at any bank or financial institution.

Required Documents

Essential documents for the Stand Up India Loan Scheme include application forms, identity proof, address proof, business-related documents, partnership deeds, balance sheets, and more.

Process to Register for Stand Up India Loan Scheme

To register for the Stand Up India Scheme, applicants must follow the steps outlined on the official website https://www.standupmitra.in/ , which include providing personal details, business information, past experience, and preferences for handholding support.

The Stand Up India Loan Scheme stands as a beacon of hope for aspiring entrepreneurs, providing them with the necessary financial support and guidance to turn their business dreams into reality. Don’t miss out on this opportunity to empower yourself and contribute to the nation’s economic growth. Apply for the Stand Up India Loan Scheme today and embark on your entrepreneurial journey!

Read more:

Empowering Your Journey: Comprehensive Guide to Education Loans

Swayam Yojana Odisha : Rs. 1 Lakh Loans, Free Skills & More for Youth Empowerment! I Sସ୍ way ୟମ୍ ସ୍କିମ୍ 2024: interest 100000 ସୁଧ ବିନା loan ଣ, କିପରି ଆବେଦନ କରିବେ?

Coop Banks Loan Interest Waiver Scheme: Financial Freedom for Karnataka Farmers: Waived Interest Opens Doors to Growth! | ಕರ್ನಾಟಕ ರೈತರು ಪ್ರವರ್ಧಮಾನಕ್ಕೆ: ಸಾಲದ ಬಡ್ಡಿ ಮನ್ನಾ, ರಿಯಾಯಿತಿ ದರದಲ್ಲಿ ₹15 ಲಕ್ಷದವರೆಗಿನ ಸಾಲ!

Borrowers, Take Note: RBI Announces New Measures for Transparent Loan Costs with Key Fact Statements

Pradhan Mantri Mudra Loan Yojana (PMMY) : PM Mudra Loan Apply Online, Eligibility

Stand-Up India Loan FAQs:

What is the Stand Up India Loan Scheme?

The Stand Up India Loan Scheme is an initiative by the Indian government aimed at empowering marginalized groups, including women, scheduled castes (SC), and scheduled tribes (ST), by providing financial assistance to establish new enterprises.

Who administers the Stand Up India Loan Scheme?

The scheme is administered by the Department of Financial Services (DFS), Ministry of Finance, Government of India, with facilitation by the Small Industries Development Bank of India (SIDBI).

What are the key highlights of the Stand Up India Loan Scheme?

The scheme offers loans ranging from Rs. 10 lakh to Rs. 1 crore for greenfield projects, with a repayment tenure of up to 7 years and a moratorium period of up to 18 months. It also provides a maximum working capital limit of Rs. 10 lakh and requires a minimum age of 18 years for SC/ST and women entrepreneurs.

What are the objectives of the Stand Up India Loan Scheme?

The primary objective is to encourage women, SC, and ST members to start their businesses, thereby promoting entrepreneurship and economic empowerment. It also aims to provide hand-holding support and guidance to aspiring entrepreneurs.

What are the features and benefits of the Stand Up India Loan Scheme?

Some key features include coverage of up to 75% of the project cost, inclusion of term and working capital loans, guaranteed lowest interest rates, provision of overdrafts, and the option to use collateral or Credit Guarantee Fund Scheme for loan guarantee.

How are interest rates determined for Stand-Up Loans in India?

Interest rates for loans under the scheme are set by participating banks based on their internal policies. However, the interest rate cannot exceed the bank’s lowest applicable rate for that category (MCLR + 3% + tenure premium).

Which banks participate in the Stand Up India Loan Scheme?

Several banks participate in the scheme, including Axis Bank, Bank of India, Bank of Baroda, ICICI Bank, State Bank of India, and more.

What are the eligibility criteria for availing the Stand Up India Loan Scheme?

The scheme is exclusively available for women entrepreneurs and SC/ST individuals above the age of 18 years. It is open to greenfield projects only, and applicants must own at least 51% of the company’s shares.

What documents are required to apply for the Stand Up India Loan Scheme?

Essential documents include application forms, identity proof, address proof, business-related documents, partnership deeds, and balance sheets, among others.

How can one register for the Stand Up India Loan Scheme?

Applicants can register for the scheme by following the steps outlined on the official website https://www.standupmitra.in/, which include providing personal details, business information, past experience, and preferences for handholding support.