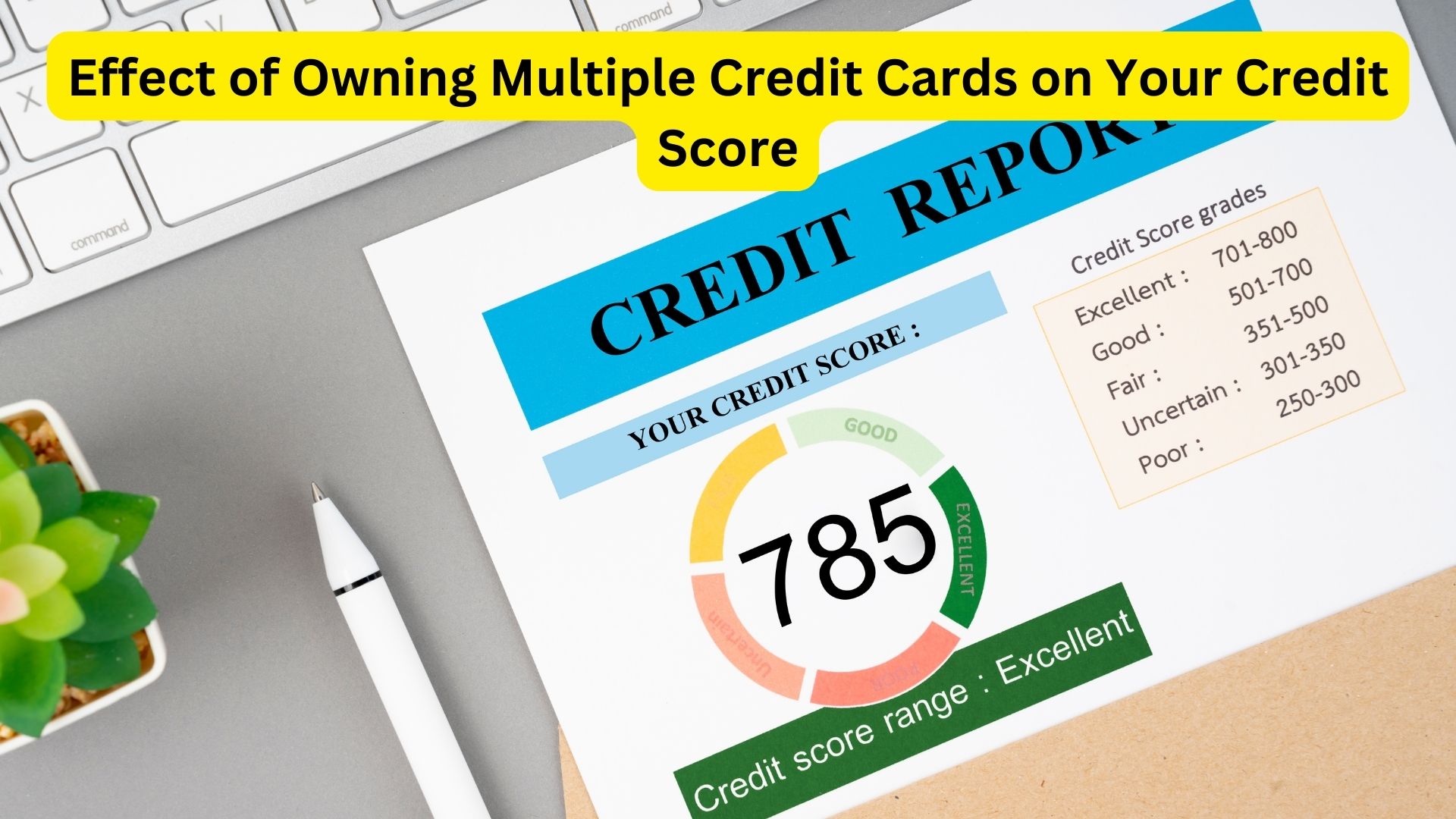

Your credit score serves as a report card on your borrowing habits, crucial for lenders assessing your risk level. Having multiple credit cards can impact this score, much like maintaining various grades affects your GPA.

Payment history holds the most weight in calculating your score, emphasizing your reliability in paying off debts. Juggling multiple cards demands careful attention to avoid missing payments, which can severely dent your score.

The debt-to-credit ratio measures your credit utilization, with exceeding 30% harming your score. While multiple cards can increase your total credit limit, it’s vital to keep utilization in check.

The age of your credit cards matters too. New cards lower your average credit age, potentially lowering your score. Those with longer credit histories tend to fare better.

The types of credit you hold also factor in, with a mix of credit types being favorable. Relying solely on multiple credit cards might not be optimal for your score.

Opening new credit accounts can briefly lower your score, signaling risk to lenders. Thus, it’s wise not to acquire multiple cards simultaneously.

In conclusion, if you’re considering multiple credit cards, stagger their acquisition to maintain your credit history’s average age. If you already have several cards, refrain from closing them to bolster your overall credit profile. Instead, manage one or two cards responsibly, monitor payments diligently, keep utilization below 30%, and periodically check your credit score to ensure financial health.

Also Read

Do You Know The -Strategies for Dodging Late Payment Fees on Credit Card Bills- Here it it!!

3 thoughts on “Effect of Owning Multiple Credit Cards on Your Credit Score”