Insufficient awareness about how to enhance one’s credit score stands as a primary obstacle for many individuals grappling with a low credit rating in India. Particularly for newcomers in the realm of credit, comprehending their credit score and report emerges as paramount for upholding a robust financial standing.

A diminished credit score can wield detrimental repercussions, notably during endeavors to secure fresh credit cards or loans. Even individuals boasting a commendable credit history must conscientiously scrutinize their credit reports to sustain a favorable credit score. Here’s a compilation of indispensable pointers to elevate your credit score:

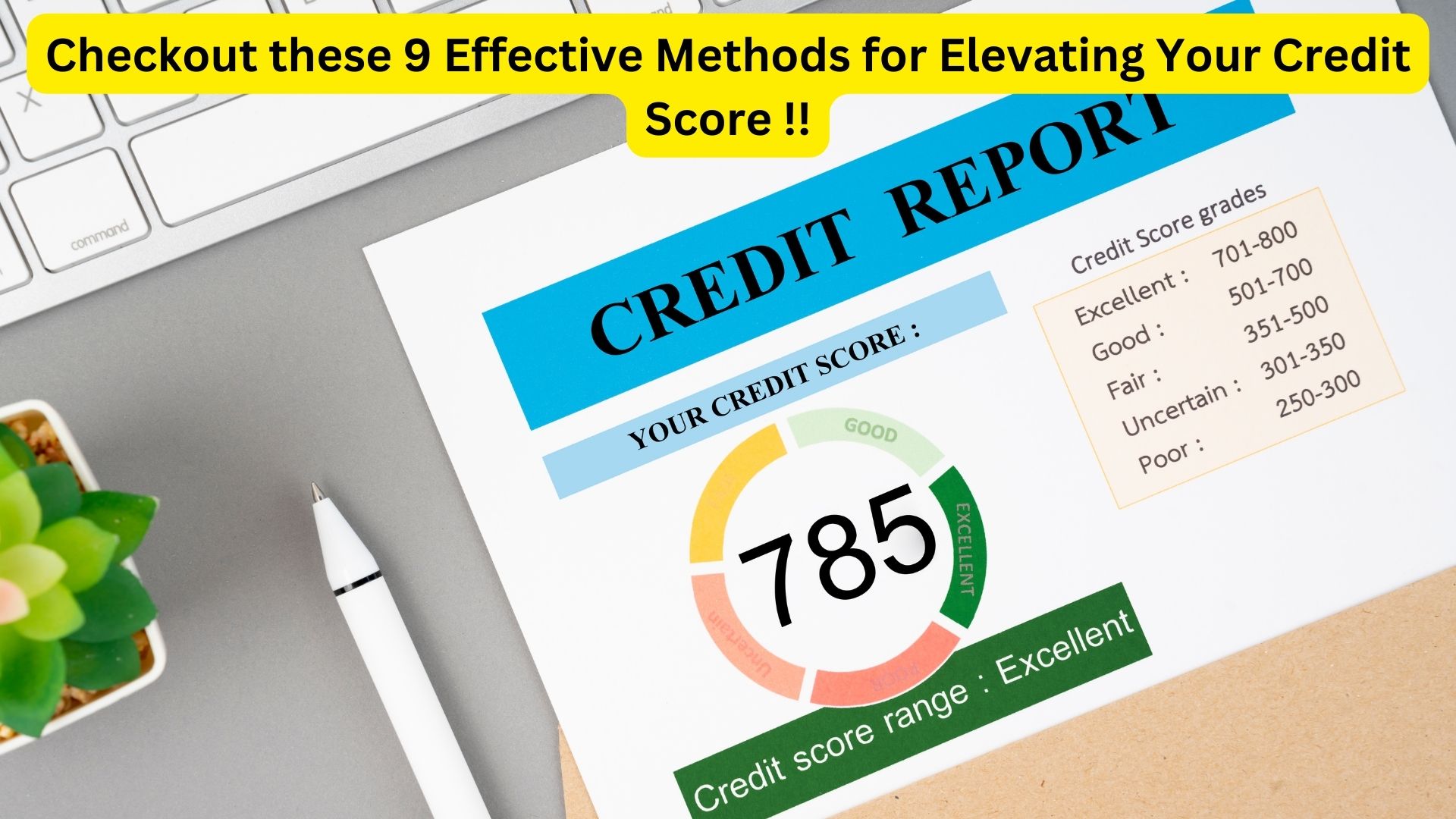

Nine Proven Techniques to Elevate Your Credit Score:

- Punctual Payments: Ensure that all repayments, whether for loans or credit card EMIs, are consistently made on time. Opt for auto-pay facilities, establish reminders, and maintain monthly task lists to avert tardy payments that could directly impact your credit score.

- Review Your Credit Report: Regularly assess your credit report for inaccuracies or erroneous information. Upon spotting any disparities, promptly raise disputes with the pertinent credit rating agency to rectify the discrepancies.

- Maintain a Low Credit Utilization Ratio: Sustain a credit utilization ratio beneath 30% of your total available credit limit. Diversify your expenditures across diverse credit products to achieve this objective. Steer clear of surpassing the 80% credit utilization threshold to showcase responsible credit behavior and heighten the likelihood of credit approval.

- Foster a Healthy Credit Mix: While unsecured loans can influence your credit score, cultivating a blend of credit types can prove advantageous. Opt for a blend of unsecured loans such as personal or business loans and secured loans like home or auto loans to mitigate risk factors and augment your credit score.

- Restrict Credit Inquiries: Simultaneously applying for multiple credits signals a voracious appetite for credit to lenders. Frequent loan applications create an adverse impression and escalate the likelihood of loan denial. Only pursue new credit avenues when genuinely warranted.

- Avoid Maxing Out Your Credit Limit: Refrain from fully depleting your credit limit as doing so amplifies your credit utilization ratio, thereby diminishing your credit score. If expenses strain your existing credit line, contemplate requesting a credit limit augmentation from your bank or lender.

- Preserve Longstanding Accounts: Shutting down old accounts or credit cards can detrimentally impact your credit score. These accounts underscore your enduring rapport with the bank and contribute positively to your credit history. Dodge nullifying this history by maintaining active old accounts.

- Monitor Co-signed Loans: Regularly monitor the status of loans for which you’ve co-signed. Unanticipated financial exigencies may cause the primary borrower to default on payments, consequently impacting your credit score. Stay abreast of co-signed loans to safeguard your credit standing.

- Secure at Least One Credit Product: Individuals lacking a credit history encounter hurdles in securing loans. Obtaining at least one credit product, such as a credit card, can aid in establishing a credit history and elevating your credit score, thus unlocking avenues to superior financial prospects.

In summation, embracing a proactive stance toward these strategies can substantially ameliorate your credit health and pave the path toward a more secure financial future.

Also Read

The New Feature of RuPay Credit Card Enables Users to Apply for EMIs Directly Through UPI App

One thought on “Checkout these 9 Effective Methods for Elevating Your Credit Score !!”