The PRAN Card, a unique identification number issued to each member of the NPS, facilitating seamless monitoring of pension withdrawals and contributions. Introduced by the Indian government, the National Pension System (NPS) offers individuals a pathway to secure their retirement by making annual contributions, thereby creating a substantial corpus for their post-working years. Initially tailored for government employees, the NPS has since broadened its scope to encompass workers across diverse economic sectors. Through the NPS, individuals have the opportunity to invest annually in a medium that offers returns linked to the market, ultimately yielding a sizable corpus upon retirement.

Understanding PRAN Card

A Permanent Retirement Account Number (PRAN) is a 12-digit identification number assigned to every new member of the National Pension System (NPS). Upon successful registration, individuals become members of the NPS and are allocated a PRAN, which plays a crucial role in monitoring pension-related activities. Each PRAN is unique and remains active throughout the subscriber’s lifetime, accessible from any part of India. It is mandatory for all NPS subscribers to possess a PRAN, with the option to obtain a physical PRAN card as a duplicate.

Documents Required

To obtain a PRAN Card, individuals need to submit important documents such as the Aadhaar card, PAN card, signature, passbook or cancelled cheque, and a passport-sized photograph.

Steps to Apply Offline

Applying for a PRAN offline entails visiting an authorized Point of Presence (PoP) under the National Pension System (NPS) and completing the NPS Application Form Annexure S1, which serves as the PRAN card application form. The application form includes personal, nomination, and employment details, along with scheme specifics, followed by submission to the relevant official.

Steps to Apply Using PAN

Applying for a PRAN Card using PAN requires the applicant to have a bank account for KYC verification. Scanned images of the PAN card and cancelled cheque, along with other necessary details, need to be submitted. Payment can be made through the National Pension System account portal https://www.cra-nsdl.com/CRA/ , either by e-signing the form or printing and mailing it to the CRA.

Steps to Apply through Aadhaar

Applying for a PRAN through Aadhaar involves KYC verification facilitated by Aadhaar OTP authentication. The online form automatically fills in demographic information and a photo from the Aadhaar database. Uploading scanned signature and photo are part of the registration process, followed by funding the NPS account through a payment gateway.

Activation of PRAN Card

For Aadhaar-based applicants, activation involves OTP verification, confirming successful activation upon verification.

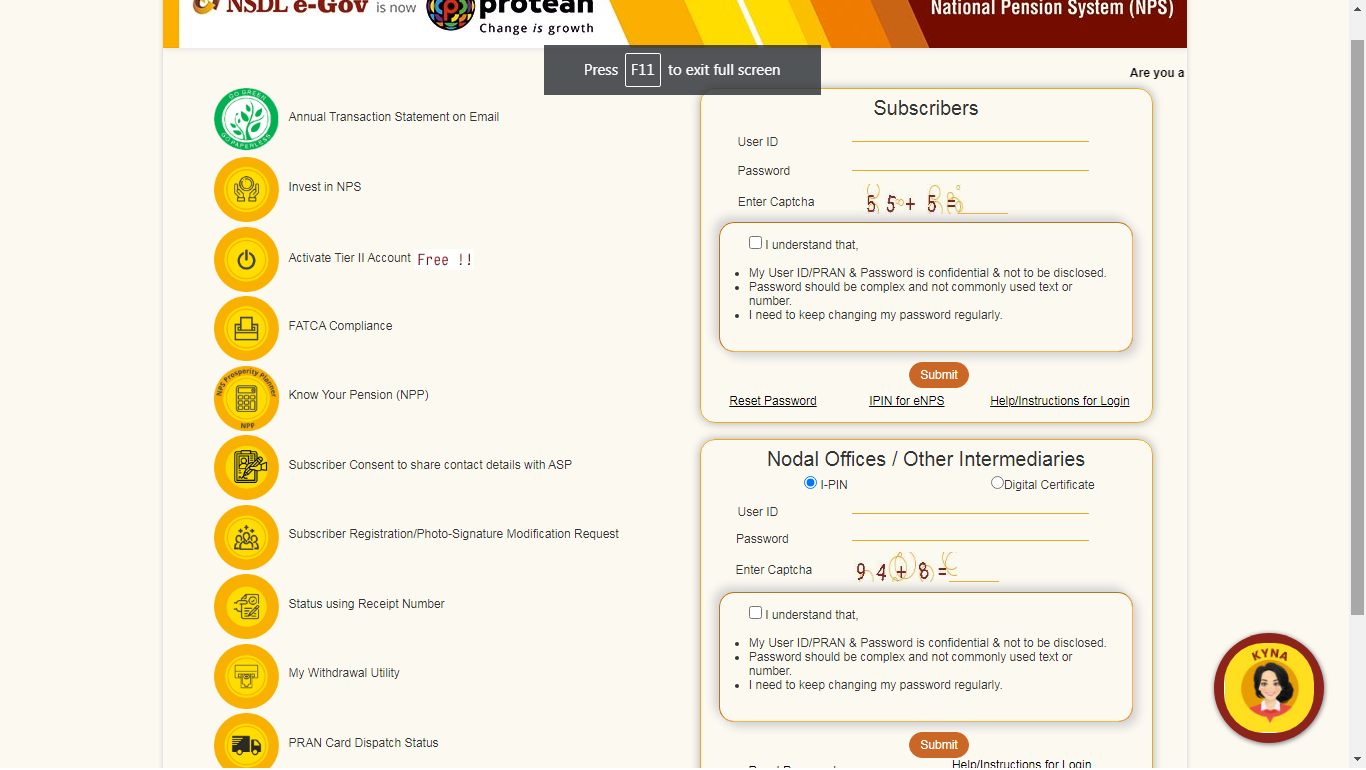

Login to PRAN Card Portal for NPS

Accessing the NPS PRAN login requires using the PRAN number displayed on the card, along with the NPS account password, on the NPS login portal.

Printing of e-PRAN

Applicants have the option to either opt for courier delivery of a printed PRAN card or print the e-PRAN from their NPS account. This digital PRAN card is essential for accessing one’s NPS account and making post-retirement claims.

In conclusion, the PRAN Card plays a pivotal role in navigating the National Pension System, ensuring financial security and stability during retirement years.

PRAN Card FAQs:

What is a PRAN Card?

A PRAN Card, or Permanent Retirement Account Number Card, is a unique 12-digit identification number issued to every member of the National Pension System (NPS). It serves as a crucial tool for monitoring pension contributions and withdrawals.

Who is eligible to apply for a PRAN Card?

Any individual who is a member of the National Pension System (NPS) is eligible to apply for a PRAN.

What documents are required to apply for a PRAN?

The documents required for a PRAN Card application include Aadhaar card, PAN card, signature, passbook or cancelled cheque, and a passport-sized photograph.

How can I apply for a PRAN-Card offline?

To apply offline, visit an authorized Point of Presence (PoP) under the National Pension System (NPS), complete the NPS Application Form Annexure S1, and submit it along with the required documents to the relevant official.

Can I apply for a PRAN using my PAN card?

Yes, you can apply for a PRAN Card using your PAN card. Ensure that you have a bank account for KYC verification, and submit scanned images of your PAN card and cancelled cheque along with other details.

What is the procedure for applying for a PRAN Card through Aadhaar?

Applying for a PRAN Card through Aadhaar involves Aadhaar OTP authentication for KYC verification. The online form auto-fills with demographic information and a photo from the Aadhaar database.

How do I activate my PRAN Card?

For Aadhaar-based applicants, activation involves OTP verification, confirming successful activation upon verification.

How can I log in to the PRAN Card portal for NPS?

To access the NPS PRAN login, use the PRAN number displayed on the card along with the NPS account password on the NPS login portal.

Can I print my PRAN Card digitally?

Yes, applicants can opt to print their PRAN-Card digitally from their NPS account. This digital PRAN card is essential for accessing the NPS account and making post-retirement claims.

Is a PRAN Card mandatory for all NPS subscribers?

Yes, it is mandatory for all NPS subscribers to possess a PRAN-Card, which serves as a unique identification number for monitoring pension-related activities within the National Pension System.

National Pension Scheme (NPS) Potential Overhaul Expected in Interim Budget 2024

NPS, PPF, or VPF: Where’s the Best Place to Invest Your Money?