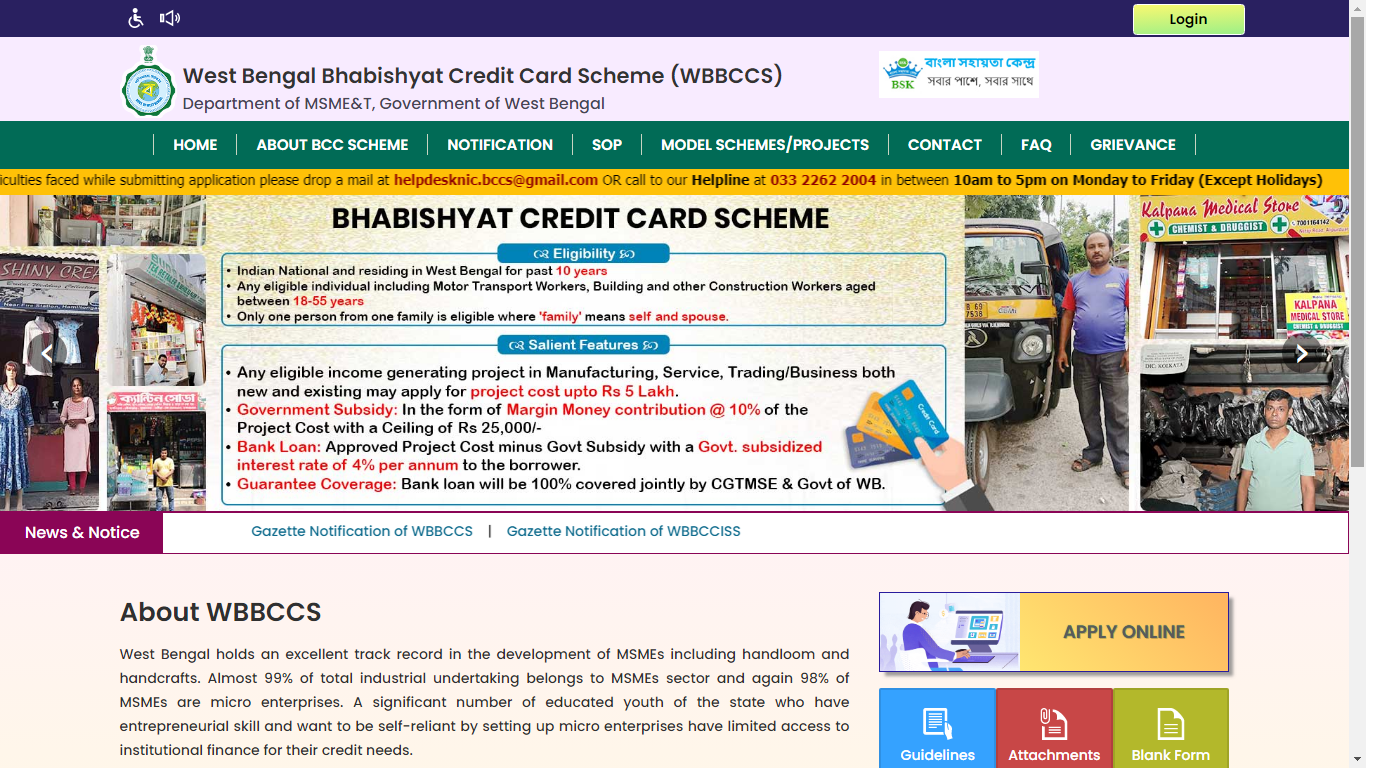

The West Bengal state government has launched an innovative program called the Bhabishyat Credit Card Scheme. This scheme offers loans up to Rs. 5 lakh and serves as a government guarantee for upcoming projects. Aspiring entrepreneurs have a great opportunity to apply for this scheme online in 2024. Read on to learn more about the Bhabishyat Credit Card Scheme and how it can benefit you.

What is the Bhabishyat Credit Card Scheme?

West Bengal has a stellar record in the development of MSMEs, such as handlooms and handcrafts. MSMEs account for about 99% of all industrial undertakings, and 98% of MSMEs are micro firms. The Bhabishyat Credit Card Scheme is designed to encourage opportunities for self-employment, particularly among young people. It provides credit cards to qualified recipients, making starting a business a profitable endeavor with prospective revenue streams. The Department of Micro, Small, and Medium Enterprises and Textiles (MSME&T) West Bengal oversees this program.

Key Details of the Bhabishyat Credit Card Scheme

- Name of the Scheme: Bhabishyat Credit Card Scheme

- Launched by: West Bengal government

- Launch Date: April 1, 2023

- Department: Department of MSME&T, Government of West Bengal

- Objective: To provide financial assistance to the state’s citizens

- Mode: Online

- Beneficiaries: Young entrepreneurs aged 18 to 55 years old

- State: West Bengal

- Official Website: Bhabishyat Credit Card Scheme

Objectives of the Bhabishyat Credit Card Scheme

Many educated young people in West Bengal possess entrepreneurial skills and aspire to become self-sufficient by establishing microbusinesses but face difficulty obtaining institutional financing for their credit requirements. The scheme aims to assist young people in becoming self-employed, generating income, creating wealth, and establishing more job opportunities in both rural and urban parts of the state.

Features of the Bhabishyat Credit Card Scheme

The scheme replaces the “Karmasathi Prakalpa” and offers subsidy-linked and collateral-free loans for establishing ventures/projects/micro enterprises in manufacturing, service, and business/trading/agro-based activities. Additional features include:

- Subsidized Interest Rate: The government pays a subsidized interest rate of 4% per annum on the loan amount for each project through banks.

- Margin Money Subsidy: A 10% margin money subsidy is offered to further ease financial pressures, with a maximum subsidy of Rs. 25,000 granted to each beneficiary.

Benefits of the Bhabishyat Credit Card Scheme

- Project Cost Grant: Beneficiaries receive a project cost grant of Rs. 5 lakh.

- Substantial Financial Boost: The bank loan is calculated based on the project cost less the government subsidy, which serves as margin money.

Documents Required for Application

To apply for the scheme, you will need the following documents:

- Bonafide certificate of West Bengal

- Aadhar card of the applicant

- Copy of ration card

- Business proforma

- Loan documents

- Copy of the PAN card of the applicant

- Recently clicked passport-size photograph

- Contact information, including mobile number

Eligibility Criteria for the Bhabishyat Credit Card Scheme

Ensure you fulfill the following eligibility criteria before applying:

- Must be a citizen of India.

- Only one member per family can enroll in the program.

- Must have been a permanent resident in West Bengal for at least ten years.

- Target market includes workers in the construction and motor transport industries aged 18 to 55.

Application Process for the Bhabishyat Credit Card Scheme

Offline Application Procedure

- Visit the official website.

- Find the application link and click on it.

- Download the application form and fill in the necessary information.

- Attach the required documents (Aadhar card, ration card, PAN card, business proforma, loan documents, and a passport-size photo).

- Submit the completed form and documents to the bank.

- The bank will verify your eligibility and, if approved, issue you a credit card worth Rs. 5 lakh.

Offline Application Procedure

You can also apply offline by obtaining the application form from the MSME&T Department’s district office. Fill out the form accurately, attach the required documents, and submit it to the office. The Block/State Level Screening Committee will verify the forms and, if accepted, send them to banks or other financial institutions for loans.

How to Login to the BCCS Portal

Follow these steps to log in to the portal:

- Visit the official website.

- Find the login option in the upper left corner of the homepage.

- Enter your username/email/mobile and password in the given fields.

- Click “Sign in.”

The Bhabishyat Credit Card Scheme provides a significant opportunity for young entrepreneurs in West Bengal to establish and grow their businesses with financial support and government backing. Apply today and take the first step towards a prosperous future.

Bhabishyat Credit Card Scheme FAQs:

What is the Bhabishyat Credit Card Scheme?

The Bhabishyat Credit Card Scheme is an initiative by the West Bengal state government to provide financial assistance to aspiring entrepreneurs. The scheme offers loans up to Rs. 5 lakh and serves as a government guarantee for upcoming projects, encouraging self-employment and business ventures.

Who launched the Bhabishyat Credit Card Scheme and when?

The Bhabishyat Credit Card Scheme was launched by the West Bengal government on April 1, 2023.

What is the primary objective of the Bhabishyat Credit Card Scheme?

The primary objective of the Bhabishyat Credit Card Scheme is to provide financial assistance to the state's citizens, particularly young entrepreneurs, to help them start and grow their businesses, generate income, create wealth, and establish job opportunities in both rural and urban areas.

Who is eligible to benefit from the Bhabishyat Credit Card Scheme?

The scheme is targeted at young entrepreneurs aged 18 to 55 years old who are citizens of India, have been permanent residents of West Bengal for at least ten years, and belong to families where only one member can enroll in the program. Workers in the construction and motor transport industries are also included.

What are the key features of the Bhabishyat Credit Card Scheme?

Key features include subsidy-linked and collateral-free loans for establishing ventures in manufacturing, service, and business/trading/agro-based activities. The scheme offers a subsidized interest rate of 4% per annum and a 10% margin money subsidy, with a maximum subsidy of Rs. 25,000 per beneficiary.

What documents are required to apply for the Bhabishyat Credit Card Scheme?

Required documents include: Bonafide certificate of West Bengal Aadhar card Copy of ration card Business proforma Loan documents Copy of the PAN card Recently clicked passport-size photograph Contact information, including mobile number

How can one apply for the Bhabishyat Credit Card Scheme online?

To apply online: Visit the official Bhabishyat Credit Card Scheme website. Find the application link and click on it. Download and fill in the application form. Attach the required documents. Submit the completed form and documents to the bank. The bank will verify your eligibility and, if approved, issue a credit card worth Rs. 5 lakh.

Is there an offline application process for the Bhabishyat Credit Card Scheme?

Yes, you can apply offline by obtaining the application form from the MSME&T Department’s district office. Fill out the form accurately, attach the required documents, and submit it to the office. The Block/State Level Screening Committee will verify the forms and, if accepted, send them to banks or other financial institutions for loans.

How does one log in to the BCCS portal?

To log in to the BCCS portal: Visit the official BCCS website. Find the login option in the upper left corner of the homepage. Enter your username/email/mobile and password. Click “Sign in.”

What are the benefits of the Bhabishyat Credit Card Scheme?

The benefits include a project cost grant of Rs. 5 lakh, a substantial financial boost from the margin money subsidy, and a maximum subsidy of Rs. 25,000 per beneficiary. The bank loan is calculated based on the project cost less the government subsidy, easing financial pressures for entrepreneurs.