Atmanirbhar Gujarat Sahay Yojana, introduced by the Gujarat government, aims to provide financial support to individuals affected by the economic downturn. Under this scheme, eligible candidates can avail themselves of loans of up to Rs. 1 lakh at a nominal interest rate of 2%. This article will explore the scheme in detail, covering its objectives, benefits, eligibility criteria, and application process.

Objective of Atmanirbhar Gujarat Sahay Yojana:

The primary goal of Atmanirbhar Gujarat Sahay Yojana is to extend credit facilities to small-scale entrepreneurs who have been adversely impacted by the COVID-19 lockdown. With a focus on reviving businesses and economic activities, the scheme offers loans of Rs. 1 lakh at a minimal interest rate of 2%.

Benefits:

- Access to Affordable Loans: Eligible individuals, including small business owners, skilled laborers, auto-rickshaw drivers, and electricians, can access loans of up to Rs. 1 lakh at a mere 2% interest rate.

- Economic Revitalization: The scheme aims to rejuvenate struggling businesses and economic sectors, fostering growth and stability amidst the challenges posed by the pandemic.

- Extended Repayment Period: Beneficiaries of the Gujarat Sahay Yojana enjoy a repayment tenure of three years, providing flexibility and ease in loan repayment.

Features of Atmanirbhar Gujarat Sahay Yojana:

- Wide Coverage: Atmanirbhar Gujarat Sahay Yojana benefits over ten lakh small-scale entrepreneurs across Gujarat, including vegetable vendors, grocery store owners, mechanics, and more.

- Substantial Fund Allocation: The government has allocated a significant sum of Rs. 5000 crores for the implementation of this scheme, ensuring adequate financial support for eligible beneficiaries.

- Insurance Coverage: Participants in the scheme are entitled to insurance coverage for loss of livelihood, offering added security and protection against unforeseen circumstances.

Eligibility Criteria for Atmanirbhar Gujarat Sahay Yojana:

To qualify for Atmanirbhar Gujarat Sahay Yojana, applicants must meet the following criteria:

- Residency: Applicants must be permanent residents of Gujarat.

- Economic Status: Individuals falling below the poverty line (BPL) category are eligible for the scheme’s benefits.

- Business Ownership: The scheme is open to small-scale entrepreneurs engaged in various businesses, such as grocery stores, auto-rickshaw services, electrical work, and more.

Required Documents:

Applicants need to provide the following documents for the scheme:

- Passport-sized photograph

- Aadhar card

- Domicile certificate

- Income certificate

- Ration card

- Mobile number

Application Process:

To apply for Atmanirbhar Gujarat Sahay Yojana, follow these steps:

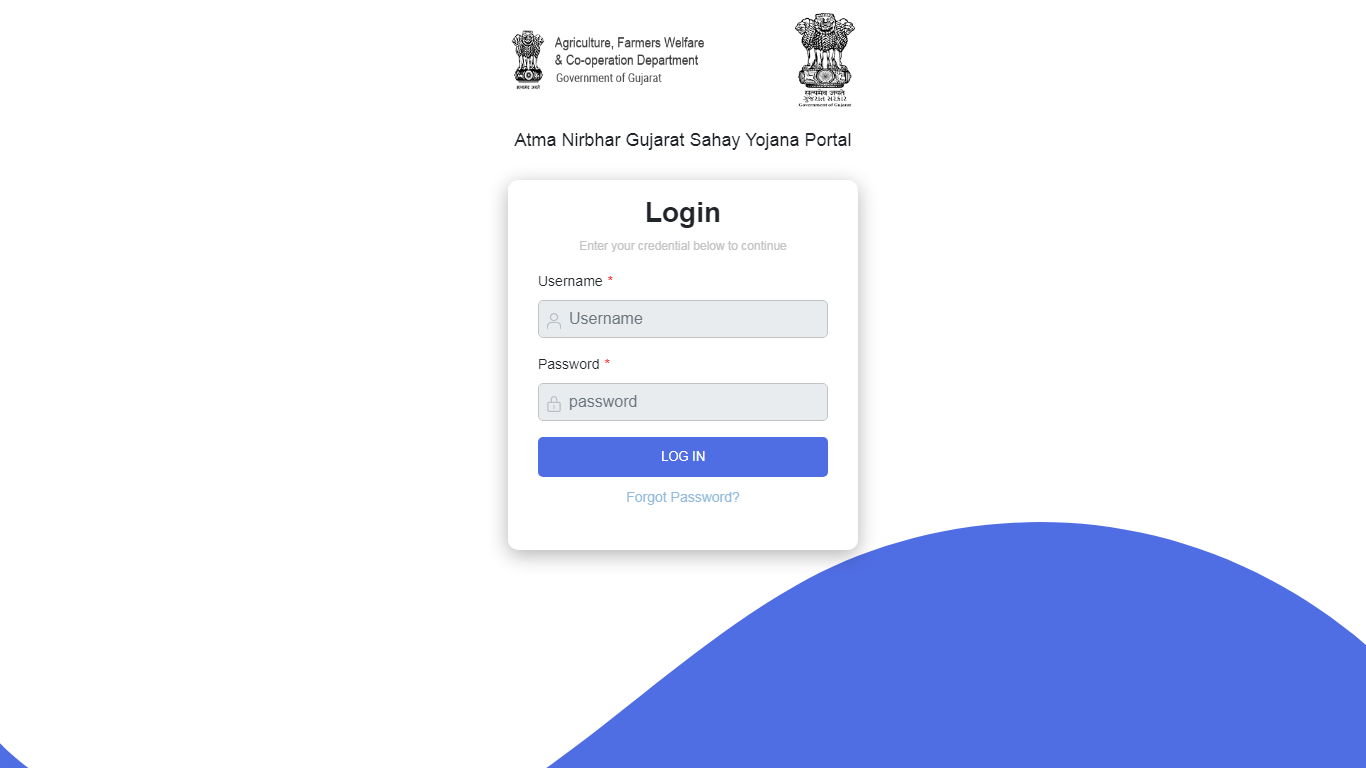

- Visit the official website of the scheme https://atmanirbhar.gujarat.gov.in/webportal/login .

- Download the Gujarat Sahay Yojana Application Form PDF.

- Fill in the required details, including personal, bank, and contact information.

- Attach the necessary documents.

- Submit the completed application form to any Gujarat State credit society, urban cooperative bank, or district cooperative bank branch.

Atmanirbhar Gujarat Sahay Yojana serves as a beacon of hope for small-scale entrepreneurs, providing them with the necessary financial assistance to overcome challenges and rebuild their livelihoods. By empowering individuals and revitalizing businesses, the scheme paves the way for a brighter and more resilient future for Gujarat’s economic landscape.

Read more:

Atmanirbhar Gujarat Sahay Yojana FAQs

Who is eligible to apply for Atmanirbhar Gujarat Sahay Yojana?

Permanent residents of Gujarat who belong to the below-the-poverty-line (BPL) category and are small-scale entrepreneurs engaged in various businesses are eligible to apply.

What is the objective of Atmanirbhar Gujarat Sahay Yojana?

The primary goal of the scheme is to provide financial support to small-scale entrepreneurs adversely impacted by the COVID-19 lockdown, thereby reviving businesses and economic activities.

What are the benefits of the scheme?

Eligible individuals can avail themselves of loans of up to Rs. 1 lakh at a nominal interest rate of 2%. Additionally, the scheme aims to rejuvenate struggling businesses, offers an extended repayment period of three years, and provides insurance coverage for loss of livelihood.

How many small-scale entrepreneurs does Atmanirbhar Gujarat Sahay Yojana benefit?

The scheme benefits over ten lakh small-scale entrepreneurs across Gujarat, including vegetable vendors, grocery store owners, mechanics, and more.

What is the fund allocation for Atmanirbhar Gujarat Sahay Yojana?

The government has allocated a significant sum of Rs. 5000 crores for the implementation of this scheme, ensuring adequate financial support for eligible beneficiaries.

What documents are required to apply for the scheme?

Applicants need to provide documents such as a passport-sized photograph, Aadhar card, domicile certificate, income certificate, ration card, and mobile number.

What is the application process for Atmanirbhar Gujarat Sahay Yojana?

Applicants need to visit the official website of the scheme, download the application form, fill in the required details, attach necessary documents, and submit the completed form to any Gujarat State credit society, urban cooperative bank, or district cooperative bank branch.

How long is the repayment period for the loans under this scheme?

Beneficiaries of the Gujarat Sahay Yojana enjoy a repayment tenure of three years, providing flexibility and ease in loan repayment.

Is insurance coverage provided under Atmanirbhar Gujarat Sahay Yojana?

Yes, participants in the scheme are entitled to insurance coverage for loss of livelihood, offering added security and protection against unforeseen circumstances.

What businesses are eligible to benefit from Atmanirbhar Gujarat Sahay Yojana?

Small-scale entrepreneurs engaged in various businesses such as grocery stores, auto-rickshaw services, electrical work, and more are eligible to benefit from the scheme.