This article is a comprehensive guide on how to make ESIC online payments, register on the ESIC portal, and utilize its features effectively. The Employee’s State Insurance Corporation (ESIC) offers a streamlined online payment system designed to ease the process of making monthly contributions for employers and employees. This initiative promotes transparency, saves time, and eliminates the need for physical visits to government offices.

ESIC Online Payment Overview

Scheme Name: ESIC Online Payment

Initiated By: Government of India

Beneficiary: Indian Citizens

Objective: To offer an online challan payment option

Payment Mode: Online

Official Website: ESIC Official Website

Objective of ESIC Online Payment System

The primary objective of the ESIC online payment system is to allow consumers to make their challan payments conveniently from home, enhancing system transparency and efficiency. This system is mandatory for both employers and employees to ensure timely contributions to the Employee’s State Insurance Corporation.

Features & Benefits of ESIC Online Payment

- Convenience: Members can now make their challan payments online, eliminating the need to visit government offices.

- Transparency: Online payments improve system transparency and tracking of contributions.

- Ease of Access: Payments can be made via SBI net banking or other bank options, accessible to all with net banking facilities.

- Mandatory Contributions: Employers contribute 4.75% of workers’ earnings, while employees contribute 1.75%. Employees earning less than ₹137 daily are exempt from contributions.

- Timely Payments: ESIC payments are due on the 15th of every month, ensuring continuous coverage and benefits.

Steps to Register on ESIC Portal

- Visit the Official Website: Go to ESIC Official Website.

- Employer Login: Click on the “Employer Login” option.

- Sign-Up: Click on the “Sign-up” option on the login page.

- Fill Registration Form: Enter all required details and click the submit button to complete the registration process.

Steps to Login on ESIC Portal

- Visit the Official Website: Go to ESIC Official Website.

- Employer Login: Click on the “Employer Login” option.

- Enter Credentials: Input your username, password, and captcha code.

- Login: Click the login button to access your account.

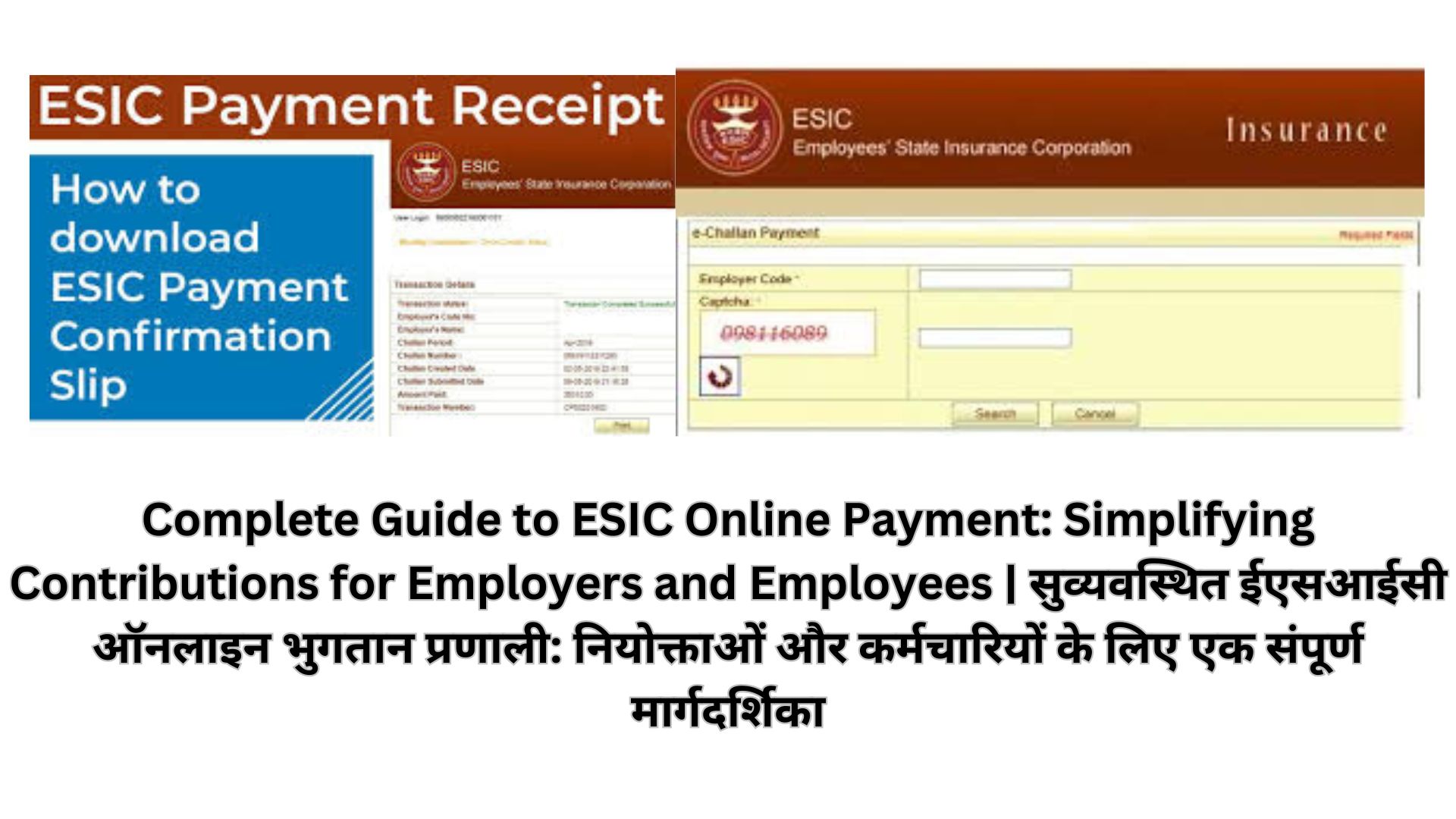

Steps for Making ESIC Online Payment

- Login to ESIC Portal: Follow the login steps above.

- Select Challan: Click on the Challan Number you want to pay.

- Net Banking Option: Choose SBI net banking or other bank options.

- Complete Payment: Enter banking credentials, verify details, and complete the payment.

- Save Receipt: Keep the payment receipt for your records.

Steps to File Monthly Contributions

- Visit ESIC Portal: Go to ESIC Official Website.

- Monthly Contribution Screen: Enter your contribution details on the Online Monthly Contribution Screen.

- Submit and Pay: Submit the details and proceed to payment through SBI net banking.

- Note Challan Number: Save the challan number for future reference.

Steps to Generate an Online Challan

- Visit ESIC Portal: Go to ESIC Official Website.

- Generate Challan: Click on the Generate Challan link.

- View and Submit: Enter payment amount, select the record, and submit.

- Complete Payment: Follow the on-screen instructions to complete the online payment.

By following these steps, employers and employees can efficiently manage their ESIC contributions, ensuring compliance and benefiting from the social security and health insurance provided by the ESIC scheme. For more details, visit the ESIC Official Website.

ESIC Online Payment FAQs:

What is the ESIC Online Payment system?

The ESIC Online Payment system is a streamlined platform designed by the Employee’s State Insurance Corporation to facilitate online monthly contributions for employers and employees. It promotes transparency and saves time by eliminating the need for physical visits to government offices.

Who can benefit from the ESIC Online Payment system?

Indian citizens, including employers and employees who are part of the Employee’s State Insurance Corporation, can benefit from the ESIC Online Payment system.

What are the primary objectives of the ESIC Online Payment system?

The primary objectives are to allow users to make challan payments conveniently from home, enhance system transparency, and ensure timely contributions to the Employee’s State Insurance Corporation.

What percentage of earnings do employers and employees contribute to ESIC?

Employers contribute 4.75% of workers’ earnings, while employees contribute 1.75%. Employees earning less than ₹137 daily are exempt from contributions.

When are ESIC payments due?

ESIC payments are due on the 15th of every month.

How can I register on the ESIC portal?

To register, visit the ESIC Official Website, click on “Employer Login,” then “Sign-up.” Fill out the registration form with the required details and submit it.

How do I log in to the ESIC portal?

To log in, visit the ESIC Official Website, click on “Employer Login,” enter your username, password, and captcha code, and then click the login button.

What steps should I follow to make an ESIC online payment?

Log in to the ESIC portal, select the challan number, choose the net banking option (SBI or other banks), enter your banking credentials, verify details, complete the payment, and save the receipt for records.

How can I file my monthly contributions on the ESIC portal?

Visit the ESIC Official Website, go to the Online Monthly Contribution Screen, enter your contribution details, submit and proceed to payment through SBI net banking, and save the challan number for future reference.

What is the process to generate an online challan?

To generate an online challan, visit the ESIC Official Website, click on the “Generate Challan” link, enter the payment amount, select the record, submit, and follow the on-screen instructions to complete the payment.

Step-by-Step Guide to Online KYC Update for Your EPF Account

Essential Documents for Updating UAN Profile: EPFO Releases Checklist for Rectifying Information

EPFO: A Guide to Online Money Withdrawal – Simple Steps to Follow