This article delves into the details of the Maharashtra Rs. 1 Crop Insurance Scheme. Agricultural losses due to climate change and natural disasters have long been a challenge for farmers. To address these issues, the Maharashtra government, under the leadership of Eknath Shinde, introduced an innovative insurance policy at just Rs. 1 to support farmers affected by natural calamities.

Maharashtra Rs. 1 Crop Insurance Scheme

In the previous year, Maharashtra experienced significant crop losses due to unpredictable weather patterns. This spurred the government to take action. Climate change has led to unexpected rainfall, hailstorms, flooding, and droughts, resulting in crop destruction and financial hardship for farmers. To combat this, Maharashtra has implemented a Rs. 1 crop insurance scheme, making it accessible to small farmers who previously faced high insurance premiums. Earlier, a 2% interest rate was charged, but now the government offers crop insurance for just Rs. 1.

Scheme Highlights

- Name of the Scheme: Maharashtra Rs. 1 Crop Insurance Scheme

- Issued by: Maharashtra Government

- Department: Ministry of Agriculture & Farmers Welfare

- Objective: To alleviate the financial burden on farmers.

- Mode: Online

- Beneficiaries: Farmers of Maharashtra

- State: Maharashtra

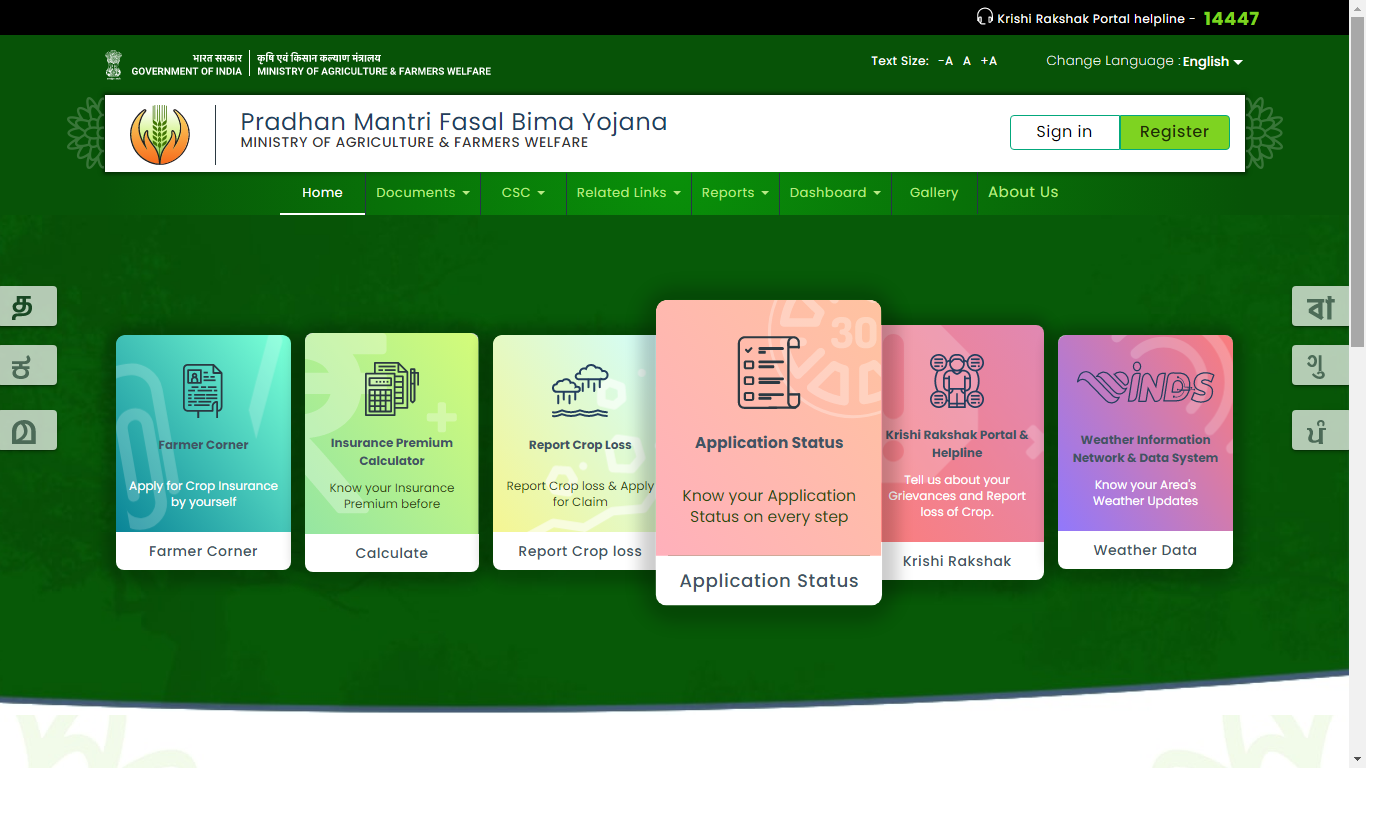

- Official Website: PMFBY

Benefits of Maharashtra Rs. 1 Crop Insurance Scheme

The Maharashtra Rs. 1 Crop Insurance Scheme offers numerous benefits:

- Significant Funding: The government has allocated substantial funds to support this scheme.

- Financial Risk Reduction: This initiative is part of a broader effort to help farmers mitigate financial risks from climate change.

- Low-Cost Premiums: Farmers pay a minimal premium to protect their crops, with compensation provided by insurance firms and the central and state governments if crops are damaged.

- Support for Small Farmers: This scheme is particularly beneficial for farmers with small landholdings or those unable to afford high premiums.

- Lower Burden: Compared to the Pradhan Mantri Fasal Bima Yojana, which has premiums of 1.5% for Rabi crops, 2% for Kharif crops, and 5% for horticultural crops, Maharashtra’s new initiative significantly reduces the financial burden on farmers.

Eligibility Criteria for Maharashtra Rs. 1 Crop Insurance Scheme

To apply for the Maharashtra Rs. 1 Crop Insurance Scheme, applicants must meet the following criteria:

- Residency: Applicants must be residents of Maharashtra.

- Occupation: Only farmers from the state are eligible to apply.

Application Process for Maharashtra Rs. 1 Crop Insurance Scheme

Here are the steps to apply for the Maharashtra Rs. 1 Crop Insurance Scheme:

- Visit the Official Website: Go to the Pradhan Mantri Crop Insurance Yojana website.

- Farmer Application: Select the Farmer Application option.

- Guest Farmer: Choose the Guest Farmer option and sign up as a new farmer.

- Provide Details: Enter the required information, including the farmer’s name, relationship (son, daughter, or wife), father’s or husband’s name, and cellphone number. Verify with OTP.

- UID Verification: Enter and verify your Aadhaar number.

- Bank Details: Fill in bank account details, including the IFSC code, state, branch, bank name, and district.

- Land and Crop Details: Provide information about the crop and land. Select the appropriate sowing date and verify account details.

- Insurance Details: Specify the area to be insured and upload necessary documents (bank passbook photo, digital signature, crop sowing declaration form).

- Payment: Make a Rs. 1 payment using a debit card, internet banking, UPI, or QR code.

- Receipt: Obtain the crop insurance participation receipt.

The Maharashtra Rs. 1 Crop Insurance Scheme 2024 is a transformative initiative for farmers, offering an affordable way to safeguard their livelihoods against natural disasters. By ensuring that farmers only pay Rs. 1 for crop insurance, the Maharashtra government is making a significant stride towards supporting the agricultural community and enhancing financial stability.

For more information and to apply, visit the official website.

Maharashtra Rs. 1 Crop Insurance Scheme FAQs:

What is the Maharashtra Rs. 1 Crop Insurance Scheme?

The Maharashtra Rs. 1 Crop Insurance Scheme is an innovative insurance policy introduced by the Maharashtra government to support farmers affected by natural calamities, offering crop insurance for just Rs. 1.

Why was the Maharashtra Rs. 1 Crop Insurance Scheme introduced?

The scheme was introduced to address significant crop losses due to unpredictable weather patterns and climate change, which have caused unexpected rainfall, hailstorms, flooding, and droughts, leading to crop destruction and financial hardship for farmers.

Who is eligible for the Maharashtra Rs. 1 Crop Insurance Scheme?

The scheme is available to farmers who are residents of Maharashtra. Only farmers from the state are eligible to apply.

How much does the Maharashtra Rs. 1 Crop Insurance Scheme cost?

Farmers pay a minimal premium of just Rs. 1 to secure crop insurance under this scheme.

What are the benefits of the Maharashtra Rs. 1 Crop Insurance Scheme?

The benefits include significant government funding, financial risk reduction, low-cost premiums, support for small farmers, and a lower financial burden compared to other insurance schemes like the Pradhan Mantri Fasal Bima Yojana.

How does the Maharashtra Rs. 1 Crop Insurance Scheme help small farmers?

The scheme is particularly beneficial for farmers with small landholdings or those unable to afford high premiums, as it offers crop insurance at an exceptionally low cost.

How can farmers apply for the Maharashtra Rs. 1 Crop Insurance Scheme?

Farmers can apply online by visiting the Pradhan Mantri Crop Insurance Yojana website, selecting the Farmer Application option, and following the step-by-step application process.

What documents are required for the Maharashtra Rs. 1 Crop Insurance Scheme application?

Applicants need to provide details such as the farmer's name, relationship (son, daughter, or wife), father's or husband's name, cellphone number, Aadhaar number, and bank account details. They also need to upload a bank passbook photo, digital signature, and crop sowing declaration form.

How is the premium payment made for the Maharashtra Rs. 1 Crop Insurance Scheme?

The Rs. 1 premium payment can be made using a debit card, internet banking, UPI, or QR code.

Where can I find more information about the Maharashtra Rs. 1 Crop Insurance Scheme?

For more information and to apply, visit the official website of the Pradhan Mantri Crop Insurance Yojana at PMFBY.